Saving money is a fine goal by itself, but to have a good sense of how much you're saving it's best to track your money. Luckily, modern technology has made doing this extremely easy. I used to track my spending each month by logging into each of my bank accounts and recording each transaction in an Excel sheet and then compared it to another sheet with my budget. Later on I used the site Yodlee, to track all my bank accounts, but found their site to often have technical problems, so I switched over to Mint.com and have been happy with it ever since.

Mint.com has been around for over 5 years now and I imagine many of you are familiar with it. For those who aren't though I'll go over why you should consider using it and how to setup your account with them. If you already use Mint, I'll go over what I use it for so that you may learn something new.

What is Mint.com?

Mint.com is a free web-based financial management service. It allows you to add your bank, credit card, investment, and other financial accounts. Once added you can easily view a snapshot of the state of your finances, every transaction from each account, how your spending and savings matches up with budgets and goals you can create. You can also further sift through your data to analyze trends or check offers that Mint provides on ways to possibly save money.

To add an account you do provide your username and password for each financial account you'd like to track, but over the 5 years I've used it I've had no problems my secure banking details becoming insecure. Mint.com uses similar security that banks use to keep the login and banking transaction data secure. It's also owned by Intuit, the make of TurboTax, Quicken, and Quickbooks which each provide similar ways to login to your financial accounts securely. Given this, I trust that my information is not being exposed to third parties.

Given that it's free, secure, and in my experience easy to use, I think it's a no-brainer addition to your financial life.

How I use Mint.com

- View Current state of My Accounts

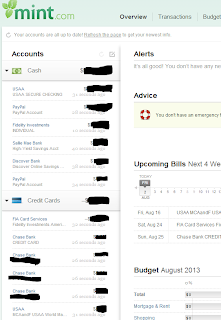

Every week I login to Mint and make sure that my accounts are updated (reasons they aren't: I've changed my bank password or technical issues on the bank's end) and then I glance at the Overview page to see the balances in each of my account. This quickly gives me a sense of how much cash I have in my bank account, the size of any credit card balances, and the amount in my investment accounts. This saves me alot of time as I don't have to log in to multiple account each week. It also allows me to quickly view if deposits or payments have gone through and if I have enough cash or credit to cover future purchases.

- Ensure Accurate Transactions

The second thing I do is click Transactions at the Top. Starting with where I left off re-categorizing last time, I look at each transaction and make sure it's a valid entry and then I make sure Mint has categorized it correctly. Ensuring your transactions are categorized correctly is important in my view as otherwise it undermines the accuracy of your budgets and likely your faith in using Mint.

If something needs to be re-categorized I either click the individual entry that needs changing and then click Edit Details below it or I check the box next to all the entries that I want to change to the same category and click Edit Multiple at the top of the page. As you make these edits you can set rules; the option to create a rule shows up each time you change a category as you can see below.

- Track Budget and Goal Progress

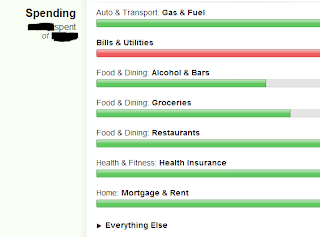

Next I track if I'm on track to meet my budgets and goals. Simply clicking the Budget tab shows me the budget I've previously created. I can edit it if I want or simply use the green/blue bars to see if I'm on track to meet my budget this month.

Similarly for the Budgets tab I can track how I'm doing saving towards my emergency fund, house, retirement or any other goal you create for yourself.

So after setting up all my accounts on Mint, I find that I only need 5-10 minutes a week to track all my spending and savings, which makes it extremely easy, realistic that I'll do it, and even satisfying to do. If you have any questions, problems, or suggestions of how you get the most out of Mint.com or other services please comment below or contact me directly.